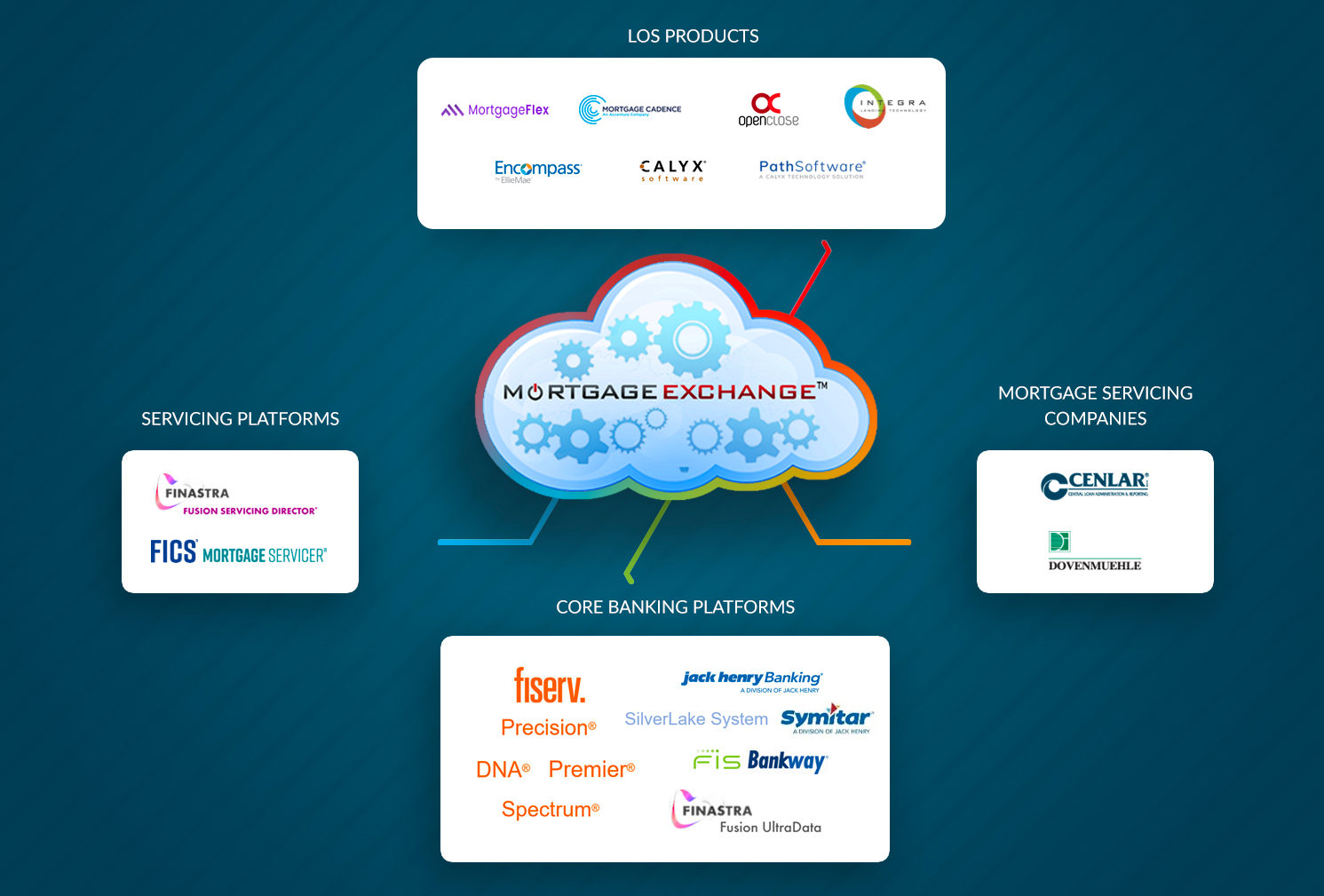

MortgageExchange- Many mortgage industry applications provide exceptional functionality—but what happens when you want to move your data between systems? Or what if you need functionality that existing applications don’t deliver? When these issues arise, many mortgage-related companies are still manually reentering data or staying with systems that don’t meet their needs. ABT focuses on the Mortgage Departments of traditional financial organizations such as Banks and Credit Unions, CUSOs and other supporting service organizations. State housing authorities, Non-Profit organizations like Habitat for Humanity as well as Mortgage Banks and Brokers. One of our core strengths is moving data between mortgage software platforms. Within Banks and Credit Unions we eliminate the need to re-key data between, Origination – Servicing – Core – Accounting.

Our attention to the secure transfer of data between software platforms as well as our SSAE 18 TYPE II Certification gives you peace of mind. We provide data security for over 700 mortgage companies nationwide. We work directly with state auditors to ensure our clients are 100% compliant with new banking standards and the safeguards rule.

Your organization receives an ABT Due Diligence package with our compliance certificates and security policies.

Prevent data breaches, costly litigation and disclosure issues

Test and Disaster Recovery environments available

ABT provides dozens of cross application integrations that give our clients the edge in business processes. We are longtime partners and have interfaces between LOS software platforms, Mortgage Servicing Platforms, and Compliance Software.

Access Business Technologies

850 Iron Point Road

Folsom, CA 95630

(888) 422-3400

info@myabt.com